SAVE $200! On The #1 Home Buying System In America!

Real Estate Expert Reveals Bulletproof Home Buying Strategy Turning 1000's Of Renters into Home-Owners in 30-Days or Less!

TheRE IS A better way

to buy real estate

The First Time Home Buyer Blueprint

Making Home Ownership Possible For Everyone. . . saving You time ,money, & Hassle While buying

Even with a 500 Credit score , no Income , or no Money Down!

4.9/5 (from 1,029+ students)

Average Subscriber Saves $9,407 on their purchase of a home

Average student secures 3.5% in down payment assistance (national average $14,000)

Average student buys a home 10x faster. Typically Within 30-Days!

Who is this for?

First Time Home Buyer Blueprint Is For Anyone Who:

Wants to buy their first home but isn't sure where or how to start

For anyone who is renting and needs to see how easy and affordable buying a home is

for anyone currently on the market to buy but isn't sure about the process and if they are working with the right lender, realtor or attorney to get the job done.

for anyone who is renting and wants to stop throwing money away in rent

for the person who doesn't think they are ready to buy a home because they think they "don't qualify" or have "enough money"

All without. . .

Having perfect credit (in fact you can buy a home with a 500 score)

Having a large income ( did you know $50K salary gets you $275,000 purchase price?)

Having saved for a downpayment ( did you know you can tap into your 401k and pension funds, or take advantage of Down Payment Assistance Programs instead of depending on your checking or savings?)

Having to pay for closing costs ( a little known strategy called a "sellers concession" can help you roll your closing costs into your loan).

How Does It Work

Sign Up!

Get access to links and video's showing you exactly what to do (videos are short and concise, this is more of a system then it is a course, its easy enough for anyone and fast to complete.)

Take action! Follow steps and actions to move closer towards home!

Buy Your Dream Home (most of our students buy a home within 30-days!)

Join the Online Community (if you are feeling stuck you are never alone, we strive to build a community to support your dream of home ownership. Frequent Q&A calls are done via video/zooms and a database of videos along with a support chat that we are launching April 2024 to help with ongoing support.)

Why Should I Join?

As Of March 2024 The National Association Of Realtors has reached a settlement.

Realtors are now for HIRE and MUST be paid by the buyer not the seller.

Now more than ever is the time to educate yourself in order to save an average of $10,000 by using this simple course alone.

90% of realtors have less than 1-year in the industry. That means most agents you will speak to have absolutely no idea how to guide you EFFECTIVELY through financing & home buying.

99% of mortgage originators are not brokers which means that they only have access to the financing options in house contrary to brokers with more robust and flexible lending options.

You likely have never bought a home. Stop trying to figure it out on your own!

Because what is taught in this course works in ALL 50 STATES!

And finally because IF YOU CAN PAY RENT, YOU CAN PAY A MORTGAGE!

You deserve to have your own home!

Whats results can I expect

A detailed roadmap from pre-approval to the closing table. No guesswork.

Access via a portal to the best mortgage broker/lender in your market depending on your financing needs (no one size fits all).

Access to nationwide inspector and attorney search via designated portals.

Market research finding the best neighborhood to buy for peace of mind.

Understanding how much home you can afford.

Access to tools that help you determine how much to offer on a property of interest.

TIME AND MONEY SAVED. . . if there is one thing that makes this program worth the money spent is the tactics, strategies & solutions built into it that you will not discover unless you spent 12 years working in the field like I have. You cannot Youtube or Google this.

$9500 saved on using a mortgage broker (database provided)

$14,500 in Down Payment Assistance (lenders provided)

Peace of mind on choosing best inspector and attorneys in your market

Time saved on filtering the search process

Money saved on blind offers ( by determining offer amount)

Sooo much more. . .

GUARANTEED RESULTS . . .

Whats included . . .

01. Finding The Right Mortgage Professional

Step 1: Financing solution

No matter your financial status, we have a solution for you.

Self employed

low income

no income

retirement income

derogatories

bankruptieces

low credit

The Right mortgage professional can be the difference between you qualifying for a mortgage or not. Most lenders have different qualifications for the same loan programs such as FHA or Conventional.

Also the right mortgage professional can help uncover creative financing options to easily qualify for a mortgage, regardless of your financial situation.

Such as a 500 credit score

No Income No Docs

Derogatories, bankruptcies etc.

Note: Choosing a mortgage broker over a retail mortgage lender can save you

$9,407 on your home purchase.

(Source: HMDA & Matt Ishbia CEO of United Wholesale #1 Lender in the Nation.)

02. Find A Top Performing Agent in Your Market

An experienced 'Buyer Agent' can save you time & money. We teach you how to find the best in your market.

All agents/realtors are not built the same. There is a way to find who has consistently helped more buyers buy homes in your market. Thats who you want to work with!

Note: Realtors are geographically based, they should ideally only know and work the market they live in, being the one you are looking to buy in.

03. Leverage Down Payment Assistance Grants & USDA 100% financing loans

Not having money shouldn't stop you from buying a home. No money down options are possible if you know how. And even if you did have the money for a downpayment leveraging these grants can offer you huge benefits & savings.

See if USDA 100% financing loans exist in your market.

Easily Access 3.5-5% in Downpayment Assistance GRANTS.

Single family: Up To $54,465.00

Two family: Up To $69,738.75

Three family: Up To $84,292.50

Four family: Up To $104,760.00

04. Roll Your Closing Costs Into Your Loan Strategically

Downpayment is only the first half. Closing costs can range from 2%-6% in additional costs depending on your market, state and qualifying factors. Discover how you can roll your closing costs into your mortgage for ultimate leverage and less money out of pocket.

Get between 3-9% in closing costs rolled into your mortgage.

Note: coupled with downpayment assistance this can virtually result in a no money out of pocket home purchase!

05. Credit Repair (Optional)

Dont let credit fears stop you from achieving home ownership. A 500 score can be enough to buy a home. But if you want to improve your scores we will show you how using tools available to you at a fraction of the cost a 'Credit Specialist' will charge.

Step by step credit repair solution (directly from credit bureaus)

Boost credit by an avg. of 100 points or more!

Do it yourself or done for you service (done for you is an added cost at checkout)

06. The Ultimate Income Hacks Framework (Optional)

Any income works. Dont be fooled, qualifying to buy a home is simpler than you think. Qualify with any, low or no income!

Employment (hourly, salary, commission)

Self employed (Schedule C, 1099, S/C Corp, K1)

Alimony, child support, social security, disability

Future rental income, cash deposits, assets and more!

No Income No Doc Solutions

07. Self employed Income Hacks Framework (Optional)

Work for yourself? Boost your income on your tax returns via loopholes to allow you to legally qualify for a larger loan amount. Buying a home as a self employed individual is easier than you think.

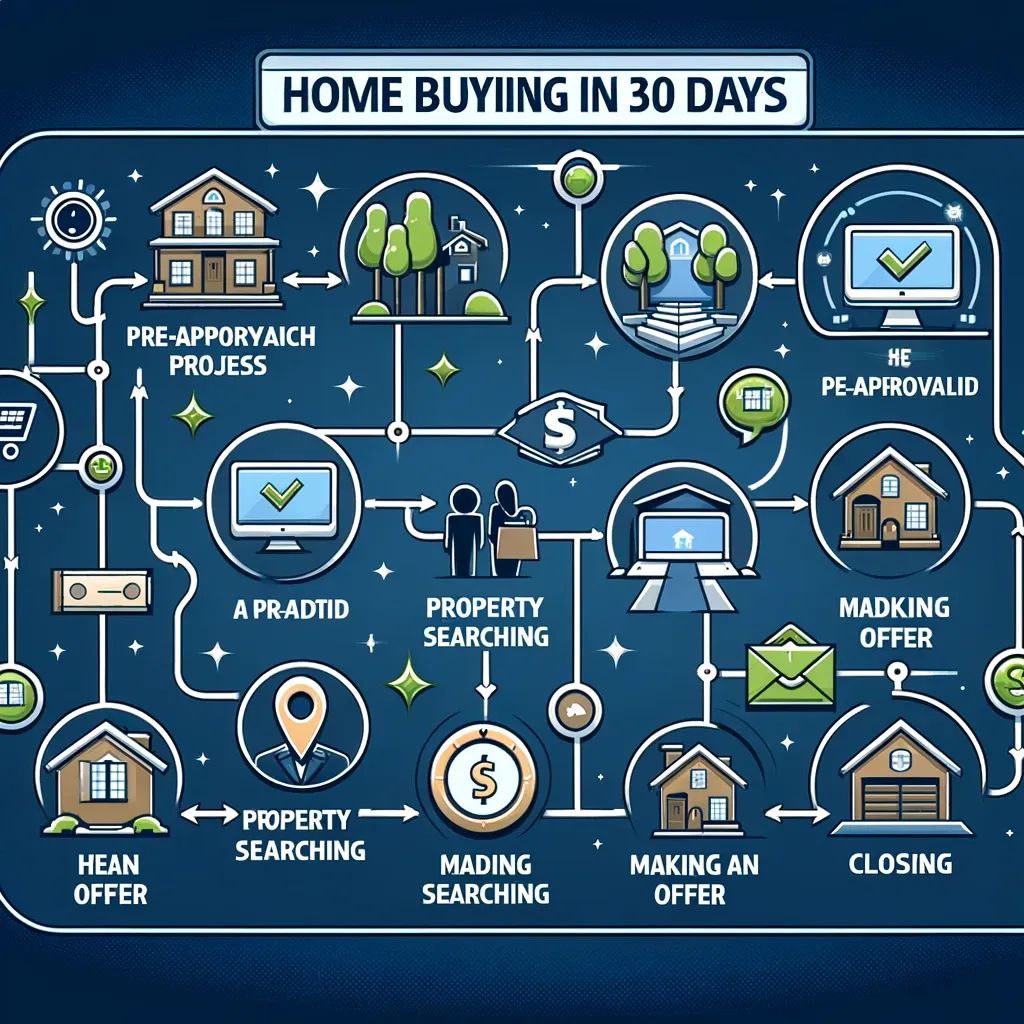

08. Home-buying in 30-days! Roadmap

Home buying made simple

Simple step-by-step guidance, for the entire home buying journey via video walk throughs, PDF's roadmap and more.

Learn the essentials of home buying

so you can be confident in every step of your purchase

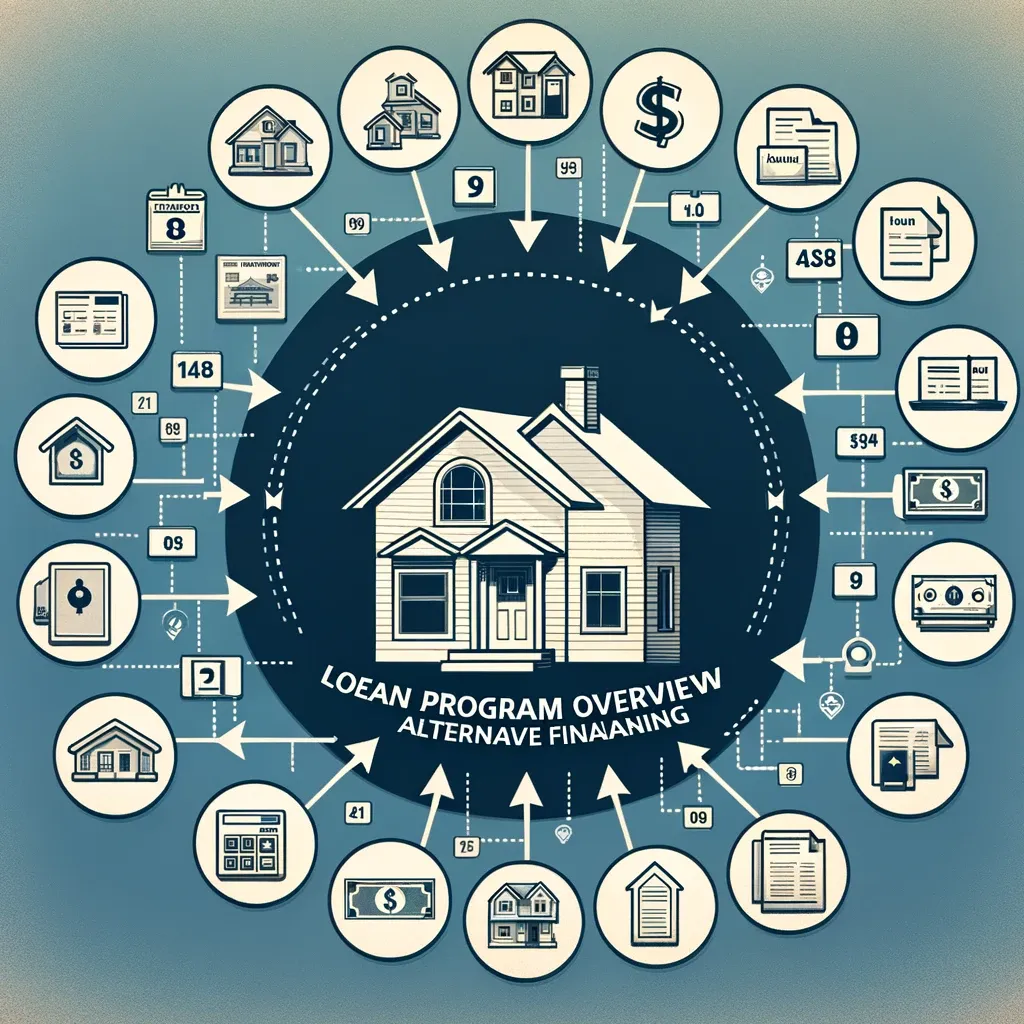

09. loan program overview & alternative financing

Not all loan programs are the same this module highlights key differences in a 10,000 ft overview of:

- FHA

- Conventional

- USDA

- DSCR (no income loans)

- Bank Statement Loans

- 1099 loans and more

10. location location location

Whether you are moving upstate or out of state this simple solution can help you rapidly choose the best market to live in without having to spend (days, weeks or months) testing a market or neighborhood to see if it is right for you.

A seamless solution to finding your next home.

11. Peace of mind: Find the best attorney and home inspector to represent you!

Access to national databases that help you identify talent. No guesswork required. Just plug in your location and scout the top attorney and home inspectors in the area to serve you and your specific needs.

Limited Time Bonuses

Exclusive Access to Our Thriving Private Online Community

Connect with like-minded home buyers

Get questions instantly answered by industry experts

Gain personalized advice, support, and inspiration from our students who have achieved the dream

Be part of a thriving community where home ownership dreams become a reality

Just Added - weekly Q&A's to answer any questions or hurdles you may have.

FREE White Glove Concierge Service For Our Students Who Purchase Their Dream Home!

Get all of your utility & service needs easily transferred and connected by one of our moving reps once you close on your dream home

Make your move super easy with dedicated moving service

Search for the best insurance premiums to save even more money when buying

"I was able to secure $17,000 in Down Payment Assistance thanks to this course. A no brainer for the price" - Thomas R.

"I always believed I wasn't able to get a mortgage. I thought my credit and income were too low. Mike showed me how wrong I was " - Rob R.

"It worked, 5% in downpayment assistance and closing costs covered by seller. My new home with no money out of pocket, cant believe it." - Maria G.

What's Included In Ultimate First Time Home Buyer Blueprint

Meet Your Instructor

Mike Duran is known as one of the most brilliant minds in real estate.

Having have worked as a realtor and a mortgage broker in his career he has been able to find creative solutions to home buying unknown to most.

Attributed to his background in engineering he leverages tech and his problem solving skills to help as many people as he can.

"The true secret to my success is making sure everyone around me wins" - Mike Duran

PS. Heres Why I can Help you

I've been working in real estate for over 12 years. I started as a leasing agent in Manhattan. Which means I know what the qualifications are to lease from a landlord. In many cases its easier to get a mortgage than a rental (if you can pay rent you can pay a mortgage).

Then I worked as a buyer agent and a listing agent selling real estate in Queens NY. I actually had built out a team of buyer agents, together we sold Curtis '50 Cents' Jacksons Jamaica Queens home.

I was featured on a real estate magazine for my swift rise to success.

Decided to pursue mortgages after starting a family hoping to spend less time on the road and more time at home especially on the weekends. Did an event to support Corrections Department in NY with the help of Curtis Sliwa.

Learned all the tricks of the trade in mortgages and bought a home away from the city. Didnt use any of my money for downpayment or closing costs.

Found my Dream home within 14 days. Securing my first contract in less than 7 and passing on it because we didn't 'love' it. While working with the #1 agent in the county.

Bought my home 45k under market value.

In a market / county that only had 7 new listings a week in the entirety of the county.

Created a course to help anyone else do the same in record time.

4.9/5 (from 1,029+ students)

Average Subscriber Saves $9,407

Average student secures 3.5% in down payment assistance (national average $14,000)

Average student buys a home 10x faster by following our plan

Frequently Asked Questions

Who Is This Course For?

This course has been created for all who desire to buy their first/dream home.

For those looking for solutions to buy a home regardless of their credit score, their income, their down payment.

For those who finally want to buy a home for their families or themselves.

For those looking for an easier way to buy a home because you know its easier than it seems.

This course is for everyone who wants to achieve the American Dream despite all of the odds.

For those who are tired of paying rent and throwing their money away.

For those who are uncomfratable and unhappy with their current living situation. this course is for you.

For the single moms, for the single dads, for the head of house holds this course is for you.

The solutions in this course have been crafted for you to finally succeed at home buying by removing the massive learning curve and bridging the gap to home buying. Buying a home can be simple and affordable with the right steps.

What Categories Do We Focus On?

Home buying step by step roadmap

Tailored home buying solutions

Mortgage financing

Creative mortgage financing

Down payment assistance

No down payment loans

Resolving credit issues

Increasing credit score

Increasing income or removing the need of using income

Assets, finding creative sources of money to use

Aligning you with the right people to aide you in homebuying

Getting you qualified for a mortgage

Showing you how and where to find your dream home

And much more.....

Who Is This Course NOT For?

Your aren't willing to take instructions and prefer to figure things out on your own with trial and error spending more time, money and frustration doing it on your own.

You do not care about buying a home and rather continue renting

You love where you live and don't want to change it

How long do I have access to the program & when does it start?

How does lifetime access sound? After enrolling, you have unlimited access to this program for as long as you like - across any and all devices you own. Inside the program there are actionable steps and checklists to guide you towards your dream home.

Can't I learn all of this from my realtor?

It's not that simple. While realtors have their expertise, they often lack the depth of knowledge in the ever-changing mortgage financing world, where policies can shift daily or weekly. Especially in regards to creative financing a specialty suited for the top mortgage originators.now whos to say you have found the right realtor? With 1.6 million realtors in the nation and a 90% fail rate, finding the right one can feel like a gamble.Why leave your dream home to chance? With the expertise provided in this program, you can navigate the home buying process confidently and potentially own your dream home in as little as 30 days.

Should I invest in Ultimate First Time Home Buyer Blueprint before talking to a lender or a realtor?

Absolutely. Before you start speaking to a realtor or a lender, invest in UFTHBB first. The fundamentals we teach you will empower you to move forward rapidly on your home buying journey. We will personally align you with the right realtor and lender to people to speak with saving you time, money and frustration. Speaking to a lender at CHASE is not the same as recruiting a Mortgage Broker with access to all the loan programs in the nation and without qualification overlays.

GUARANTEE

Ultimate First Time Home Buyer Blueprint has a 90-Day Put Your Money Where Your Mouth Is Satisfaction Guarantee. If you are not completely SATISFIED and EMPOWERED by what you have learned in the Ultimate First Time Home Buyer Blueprint Program, then contact us within 90 Days for a full refund, no questions asked!

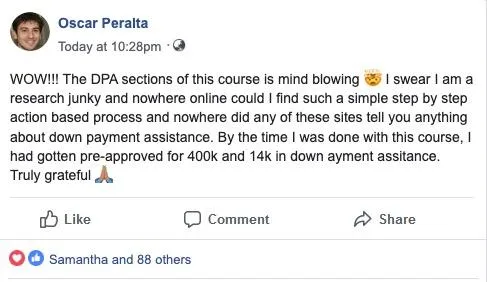

MORE TESTIMONIALS